Additionally, the investigators were collecting “lifestyle” information on data subjects, including their sexual orientation, marital status, drinking habits, and cleanliness. To do this, some investigators fabricated negative information, others included incomplete information.

By the 1960s, significant controversy surrounded the CRAs because their reports were sometimes used to deny services and opportunities, and individuals had no right to see what was in their file.īy the late 1960s, there was abuse in the industry, including requirements that investigators fill quotas of negative information on data subjects. Over the years, Retail Credit purchased smaller CRAs and expanded its business into selling reports to insurers and employers. The first major credit reporting agency, Retail Credit Co, was started in 1899. The FCRA was the first federal law to regulate the use of personal information by private businesses. The FCRA was passed to address a growing credit reporting industry in the United States that compiled “consumer credit reports” and “investigative consumer reports” on individuals. Text of the Fair Credit Reporting Act of 1970, 15 U.S.C.The Federal Trade Commission (FTC) issues commentaries on the statute, but does not engage in rulemaking for the FCRA.ĬRAs may also be referred to as “credit bureaus” or “consumer reporting agencies.” To do so, the FCRA establishes a framework of Fair Information Practices for personal information that include rights of data quality (right to access and correct), data security, use limitations, requirements for data destruction, notice, user participation (consent), and accountability. The Act’s primary protection requires that CRAs follow “reasonable procedures” to protect the confidentiality, accuracy, and relevance of credit information. The FCRA is a complex statute that has been significantly altered since 1970 by Congress and the courts. The FCRA provides important protections for credit reports, consumer investigatory reports, and employment background checks. 91-508, was enacted in 1970 to promote accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).ĬRAs assemble reports on individuals for businesses, including credit card companies, banks, employers, landlords, and others. The Fair Credit Reporting Act (FCRA), Public Law No. Birth certificates and other vital records: call the state's vital records office or visit the vital records website.The Fair Credit Reporting Act (FCRA) and the Privacy of Your Credit Report.There are various organizations that can help you replace documents that may have been stolen or lost and place alerts on those records.

Free credit report colorado license#

Free credit report colorado free#

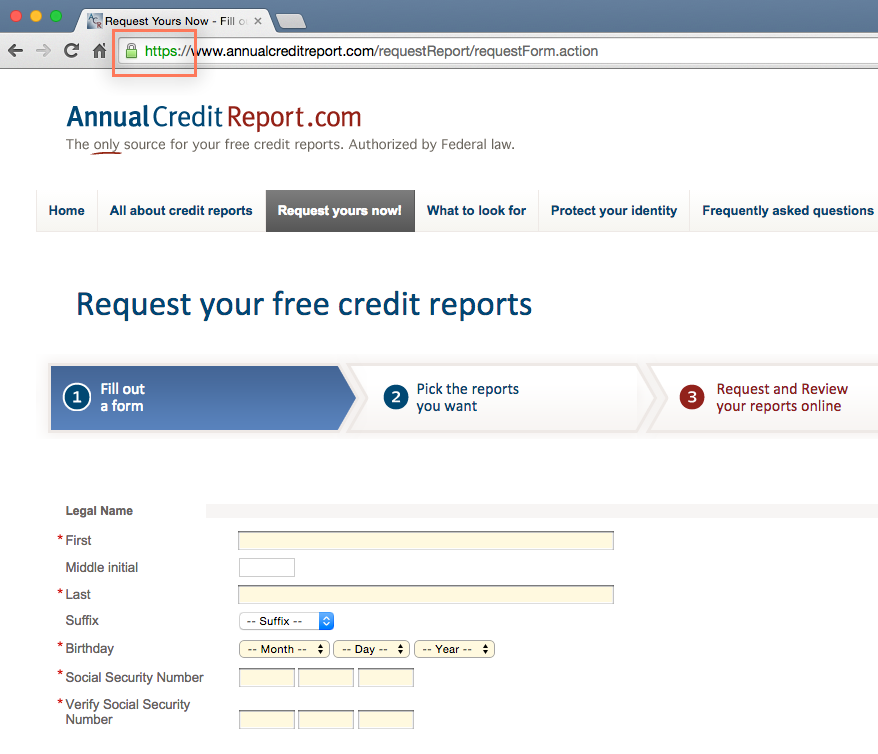

Request a Fraud AlertĬall, or go online, to one of the three major credit reporting agencies to place a "fraud alert" or "credit freeze" on your name and social security number and request a copy of your free credit report at the Annual Credit Report website. If the theft occurred in unincorporated Jefferson County you may call JeffCom's non-emergency number anytime at 30 or report it online. Have any documents or copies of documents available for the officer when making your report. The police will need any credit card statements, copies of checks or other information you obtain for their investigation. Report and dispute the fraudulent charges and close the affected account(s). What to Do if Your Identity Has Been Stolen Call your Credit Card Company or Bank as Soon as Possible

0 kommentar(er)

0 kommentar(er)